Xingsheng Commercial (6668.HK): Fine operation and high -quality development drive, high shareholders’ return shows the value of value

- by proamteam

Since the port clearance last year, Shenzhen has become a popular destination for Hong Kong residents to play on weekends.

Under this trend, as the most popular shopping mall “Shenzhen Futian Star River Coco Park”, the most popular shopping mall in the Shenzhen CBD region, has launched a series of unique “The “Hong Kong Trend” activity attracted the experience of the Hong Kong Chief Executive and the Mayor of Shenzhen, and also became the preferred destination of Hong Kong guests north.

Since its opening in 2006, the Coco Park has been unique in the country with its unique positioning and continuously promoted new. In the external environment that is constantly changing and competitive, it can always move with the trend, accurately grasp market opportunities, and continueHuanxin.Behind this is inseparable from the careful operation of Xingsheng Commercial, the business operation service provider of the Greater Bay Area.

However, Xingsheng Commercial is not only the brand and benchmark of the urban -type shopping mall Coco Park. Its also owns a regional shopping mall COCO City, a community shopping center COCO Garden, and a high -end home shopping center Xinghe · Third Space., Together, it constitutes its rich and diverse business layout.

Recently, Xingsheng Commercial released its annual performance in 2023. It shows that the company still achieves the double -digit growth of revenue and net profit in the context of the macroeconomic environment.; The net profit of home also reached 171 million yuan, an increase of 10.9%year -on -year.

The annual net cash inflow of operating cash was 299 million yuan, an increase of 84.9%year -on -year, and the net proportion was 1.75, which achieved quality profits. The annual dividend of 13.0 Hong Kong immortals per share was 23.8%year -on -year, with a dividend rate of 70.0%.

Facing the disturbance of the macroeconomic cycle, how does Xingsheng Business achieve such a proud result?Presumably many investors want to explore one or two. Based on the company’s financial report, the author explores the secrets of its rebellious growth.

1. Multi -mode achieve comprehensive growth, and future development is certain

As the leading commercial operating service provider in the Greater Bay Area, Xingsheng Commercial, through deep layout of multi -brand shopping malls, provides comprehensive solutions including property management, brand management output, and rental services, to achieve itSteady profit.

Specifically, the company not only provides all -round commercial property operation services such as increasing passenger flow and improving property value, but also output valuable brand and management experience to partners, thereby gaining diversified income such as brand use fees and management consulting fees.In addition, through the property transformation and efficient operation of the whole rent model, the company has successfully achieved rental income and asset appreciation.

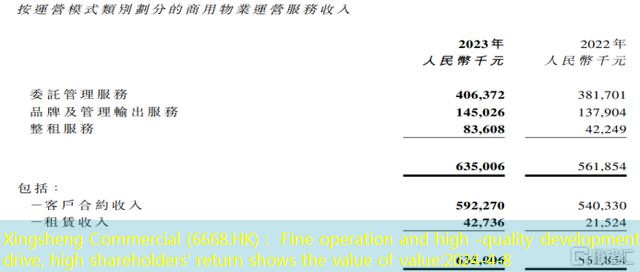

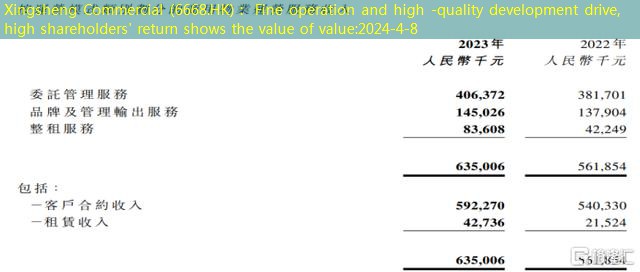

In 2023, Xingsheng Business has achieved significant growth in various major operating models.Among them, the year -on -year growth rates of entrusted management services, brand and management output services, and rental services reached 6%, 5%, and 98%, respectively, fully showing the strong growth momentum of the company’s business.From another dimension, customer contract revenue and rental income have also achieved 10%and 99%year -on -year growth, respectively, further confirming the company’s excellent operating strength and market recognition.

Source: Company Financial Report

In terms of project regional layout, the company focuses on high -energy cities with active economic development and great potential, adhere to strategic and regional focus, and stabilize foreign exposure.This strategy not only ensures the quality of the company’s property assets, but also lays a solid foundation for the company’s sustainable development.

As of 2023, the company has opened 11 shopping malls in Shenzhen, 18 has opened in the Greater Bay Area.

Source: Company Information, Gedon Hui Settlement

From the perspective of operating efficiency and operating efficiency, the company’s opening project has achieved excellent performance of 18%of cumulative sales growth in the same store in 2023 and a cumulative increase of the same store passenger flow.At the same time, the rental rate and collection rate at the end of the year also increased by 0.3 and 1.3 percentage points from the end of 2022, reaching 92.8%and 99.8%of the high levels.In addition, the number of cooperative merchants has also increased to 5,000, an increase of 4.2%over the previous year, highlighting the company’s strong commercial operation capabilities and close stickiness with merchants.

Source: Company Information, Gedon Hui Settlement

Looking forward to the future, the development of Xingsheng Commercial is full of certainty.In 2023, the company successfully expanded the flagship product line COCO Park from Shenzhen to Nansha and Liwan, Guangzhou, and further entered the Fujian market, achieving a major breakthrough in the dual centers and nationalization of the nation’s strategic layout.

In addition to the 27 projects that have been opened, the company has up to 20 projects in close preparations. From the quantity point of view, most of them are community shopping centers and regional shopping malls.Regional and community shopping malls are important places to meet people’s daily needs. Usually integrate shopping, catering, entertainment, leisure and other functions to provide consumers with one -stop services.In addition, regional shopping malls are usually located in the important or potential development area of the city, and have high passenger flow and popularity gathering effects; community shopping malls are closer to residential areas to facilitate residents’ daily shopping and living needs.

Therefore, from the perspective of the company’s two types of high commercial value shopping malls, it indicates that the company will achieve more richer business results in the future.

2. Refined operation and high -quality development

To achieve the above -mentioned good results, the business strategy of pursuing Xingsheng Commercial, and adhering to the development of quality and high quality throughout it.

In the past many years, Xingsheng Commercial has established a business management system with a full industrial chain and full process.Force, to help the company’s high -quality development.

In the construction of benchmark projects, Xingsheng Business shows its keen sense of business.Build the first destination of the Hong Kong customers in the Futian Coco Park, continuously iterate the new motivation of the project, and successfully convert the “traffic” into “retention” through multi -dimensional efforts;Shenzhen Xinghe World Park 1.6 million m2 pure oxygen hinterland and project “urban roaming land” positioning to achieve the speedy city roaming and create the landmark of Shenzhen light travel City.

Source: Company Information, Gedon Hui Settlement

Xingsheng Commercial has always adhered to the opening of quality and marketization.In 2023, the company successfully achieved the high -quality opening of six new projects, and all of them were the first to enter the city or region. Not only were they unanimously praised by the industry, but also injecting new vitality into the local economy.In the operation of multiple third -party projects, its performance is also bright, and the leasing rate has achieved a steady rise.

The company adheres to quality operations and deeply digging consumption potential. Through cross -border resource linkages, upgrading of member system, and blessing of government units, leverage the attention of young groups. While improving the brand power of COCO, it helps marketing activities to maximize the efficiency of investment.

In terms of membership services, its innovative “five friendly” service system has been implemented to meet the diversified needs of members; in the member system, the original three -level member system has been successfully fissioned into five levels, which further enhanced the membership of members’ belongingsFeelings and stickiness.These efforts have achieved remarkable results in 2023. The company’s membership scale, V card members, high -end members, online orders, and membership repurchase rates have all achieved significant growth.

Source: Company Information, Gedon Hui Settlement

In addition, Xingsheng Commercial also actively empowerment through digitalization, creating a smart retail management system integrating commercial packets, consumer side, and data operation analysis.Strong support.

In the context of consumption recovery, commercial management enterprises with refined operating capabilities will undoubtedly usher in new development opportunities.With its excellent comprehensive strength and profound management experience, Xingsheng Business is expected to release greater value in the future and lead the industry’s high -quality development.

Third, high cash, high -quality profits, high returns

Xingsheng Commercial has not only achieved significant achievements in business operations, but its financial performance is equally remarkable.

Over the years, the company’s mobile assets account for more than 60%, which mainly constitutes cash and cash equivalents and bank wealth management products.In 2023, Xingsheng Commercial’s total assets were 2.325 billion yuan, and at the end of the period, it was 1.437 billion yuan in hand, accounting for about 61.80%of the total assets. It has good asset texture and sufficient liquidity.

In 2023, the company continued to increase the collection of receivables, realized a net outflow of operating cash of 299 million yuan, a net income of 1.75, at the end of the period, 1.437 billion yuan in cash, and achieved capital income of 39.24 million yuan.

The net is usually used to judge the quality of a company’s profit. In 2023, the company realized a net profit of 171 million yuan, and the operating net cash inflow was 299 million yuan, and the net income reached 1.75.That is to say, the company’s average profit of one yuan corresponds to 1.75 yuan of net cash inflows at 1.75 yuan. The net cash inflow of business activities is much higher than its book net profit, and the amount of net profit is very high.

If it is eliminated, it is not difficult to find that this is not the accident of this year, but the company’s operating performance.

Source: choice

This also fully confirms the attitude of the company’s management: adheres to the management of quality and the pursuit of high -quality development.

For investors, the continuous profitability of listed companies and stable increase in cash dividend dividends are their important indicators to adhere to long -term investment and achieve long -term shareholding.

Since the company was listed in January 2021, in the past three years, the company’s dividend rate is 45%, 62%, and 70%in turn.23.8%, the dividend rate is as high as 70%.

If the closing price of March 22, 2024 is HK $ 1.31 per share, the company’s dividend rate reaches 9.92%.

Therefore, it can be said that this is a company that continues to stabilize high scores to give back to shareholders.

Such a healthy and stable financial performance also provides a solid foundation for the company’s stable operation and sustainable development.

Fourth, strong shareholders to escort

After in -depth discussing the refined operating strategies, high -quality development paths and excellent financial performance of Xingsheng Business, it is not difficult to find that behind these success, in addition to the company’s own efforts and strength, there are strong backing giving giving giving shields to give it toIts support is that its holding parent company -Xinghe Holdings.

In the industry, Xinghe Holdings has the business philosophy of “stable operation and high -quality development”, and the financial situation is stable.From 2021 to 2023, Xinghe Holdings won the AAA main credit tracking rating for three consecutive years, and the rating outlook was stable.In 2023, under the background of the real estate industry, Xinghe Holdings still maintained a steady growth, with sales and repayments of nearly 30 billion yuan, an increase of 18%year -on -year. In addition, Xinghe Holdings revenue in 2023keep it steady.

At present, 100%of Xinghe Holdings Development and own commercial properties are operated by Xingsheng Commercial.Xingsheng Commercial maintains long -term stable cooperation with the parent company. In the future, Xinghe Holdings will still provide more high -quality commercial asset reserves, injecting high certainty into the continuous growth of Xingsheng business performance.

Conclusion

To sum up, with its refined operation and high -quality development business strategies, Xingsheng Business has achieved good operation and financial performance in 2023. Its healthy financial situation and continuous and stable high -scoring policy are also worth investors.Approve.

Recent Posts

- Chen Qiqiang, director and financial director of Shenyang Commercial City Co., Ltd., resigned

- Wuxi Xin’an: Health and Health Couple

- Taiyuan Food Practitioner Electronic Health Certificate Application Process and Certificate Photos Selfie Method

- Top ingredients 丨 Representative food in various countries, each one is very attractive. How many types have you eaten?# #子

- [Italian Food] The changes in microbial flora and the impact on the flavor during the mature process of Sarami

Recent Comments